What Acctally does (in plain terms)

A clear explanation of how Acctally helps you manage money, whether you know accounting or not.

The one-sentence version

Acctally records every money movement, figures out what it means, applies tax rules automatically, and produces reports that are both founder-friendly and accountant-ready.

The problem we solve

Most businesses track money in spreadsheets or basic tools that don't understand accounting. This creates three problems:

- Tax time panic. You scramble to figure out what you owe, what you can deduct, and whether your numbers are even correct.

- No real visibility. You know money came in and went out, but you can't quickly answer "Am I actually profitable?" or "Where is my cash going?"

- Accountant dependency. You need an accountant just to understand your own finances, and their work is often delayed or expensive.

Acctally fixes this by doing the accounting work automatically, while keeping things simple enough for founders and detailed enough for accountants.

What Acctally actually does

Think of Acctally as three things in one:

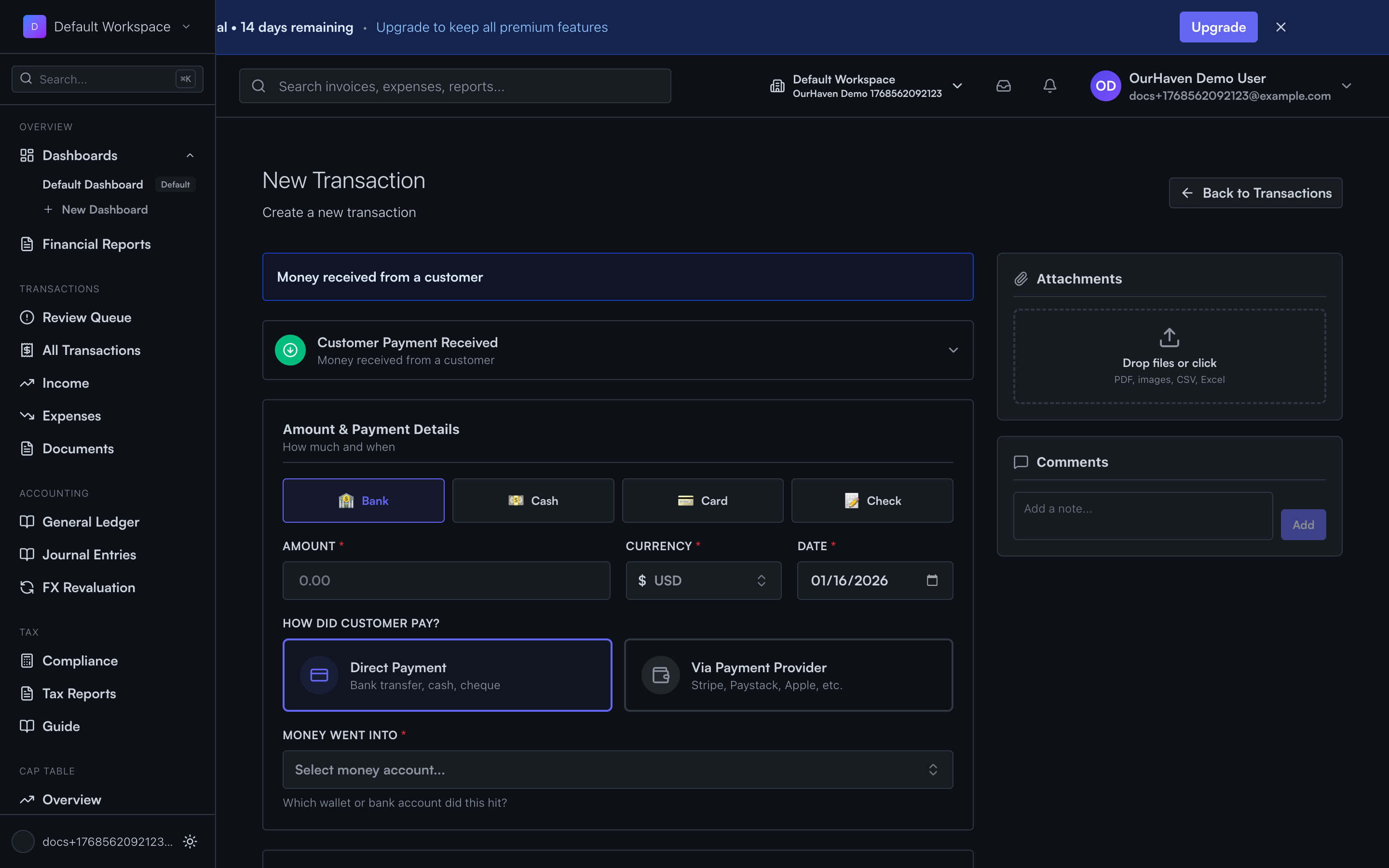

1. A transaction recorder

Every time money moves (customer pays you, you pay a supplier, you transfer between accounts), Acctally records it with all the details: amount, date, who it was, what category, which account.

This can happen automatically (via Paystack, Stripe, bank integrations) or manually (you enter it yourself or import a CSV).

2. A classification engine

Recording a payment is not enough. Acctally figures out what the transaction means:

- Is this income or expense?

- What category does it belong to?

- Does VAT apply? What about withholding tax?

- Is this a one-time payment or part of a recurring pattern?

If Acctally isn't sure, it flags the transaction for your review instead of guessing wrong.

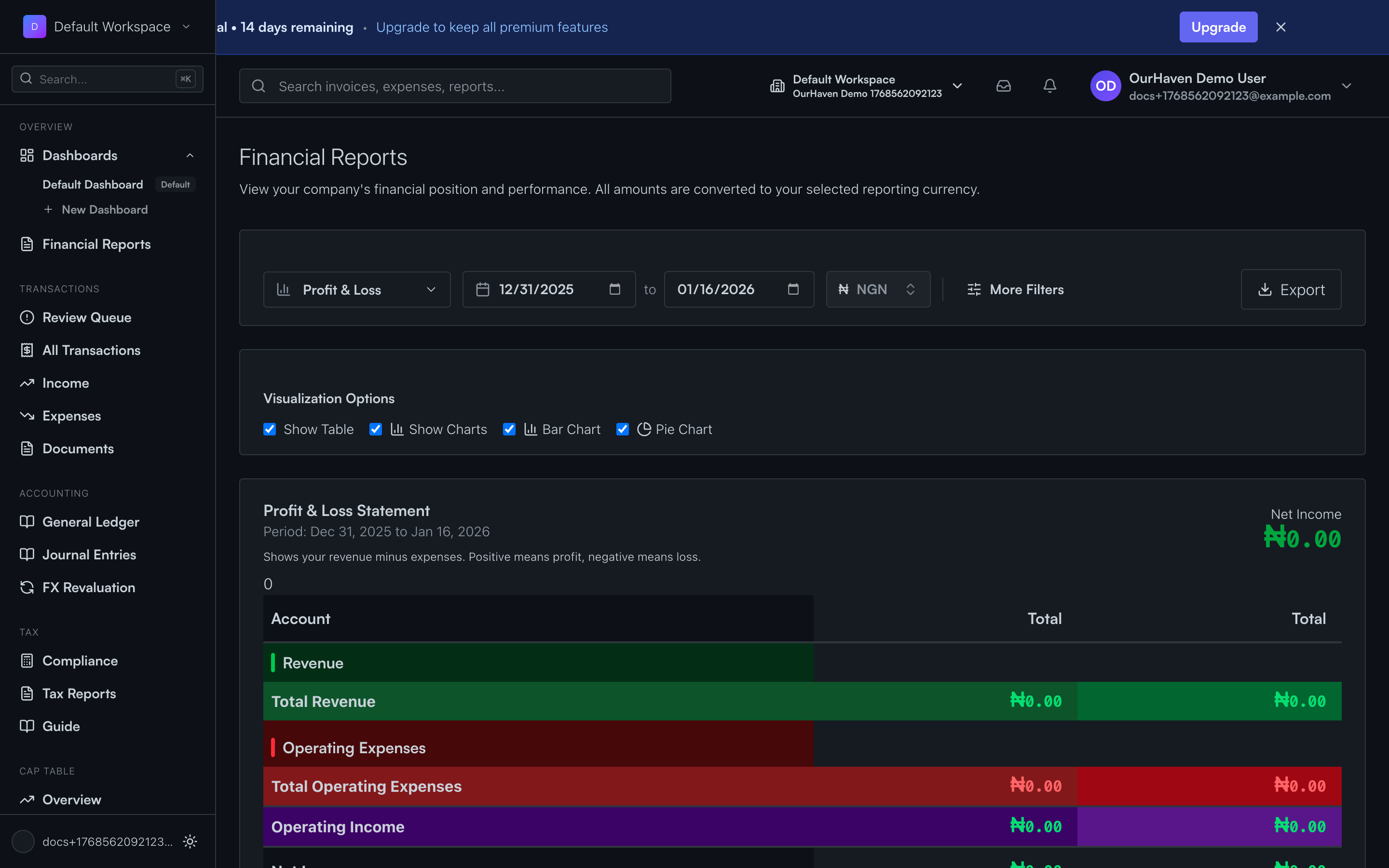

3. A report generator

Once transactions are recorded and classified, Acctally produces reports that answer real business questions:

- Profit and Loss: Did we make money this month?

- Cash Flow: Where did money come from and go?

- Tax Summary: What do we owe in VAT, WHT, or other taxes?

- Account Balances: How much is in each bank account right now?

How it works (the 30-second version)

Money moves

A customer pays you, you pay a supplier, or you transfer money between accounts.

Acctally records it

Either automatically (via integrations) or when you enter it manually.

Acctally classifies it

It assigns a category, applies tax rules, and posts the journal entries.

Reports update instantly

Your P&L, cash flow, and tax numbers are always current.

For founders (non-accountants)

You don't need to understand debits and credits. Acctally hides the complexity:

- Simple language. You see "Income" and "Expense", not "Debit" and "Credit".

- Smart defaults. Tax rules, categories, and settings are pre-configured for your country and industry.

- Clear guidance. When something needs your attention, Acctally tells you exactly what to do.

- No GL accounts. You work with categories like "Office Supplies" and "Service Revenue", not account codes.

For accountants

The simplicity is a layer on top. Underneath, Acctally does real accounting:

- Double-entry ledger. Every transaction creates proper journal entries. The books always balance.

- Full chart of accounts. Categories map to GL accounts. You can view and export the full ledger.

- Accrual and cash basis. Reports can be generated either way, depending on what you need.

- Tax compliance. VAT, withholding tax, and other obligations are tracked and reported correctly.

- Audit trail. Every change is logged. You can trace any number back to its source.

Pro tip: When an accountant joins a business using Acctally, they inherit clean books. No reconstruction needed. They can focus on advisory work, not data entry.

What Acctally is NOT

To be clear about scope:

- Not an invoicing tool. Acctally doesn't create or send invoices. It records the payment when an invoice is paid.

- Not payroll software. Acctally can record salary payments as expenses, but doesn't calculate payroll or deductions.

- Not a bank. Acctally tracks money, but doesn't hold it or move it. It integrates with your existing accounts.

- Not tax filing. Acctally calculates what you owe and generates reports, but you or your accountant still files with the tax authority.

Key concepts you'll see

As you use Acctally, you'll encounter these terms:

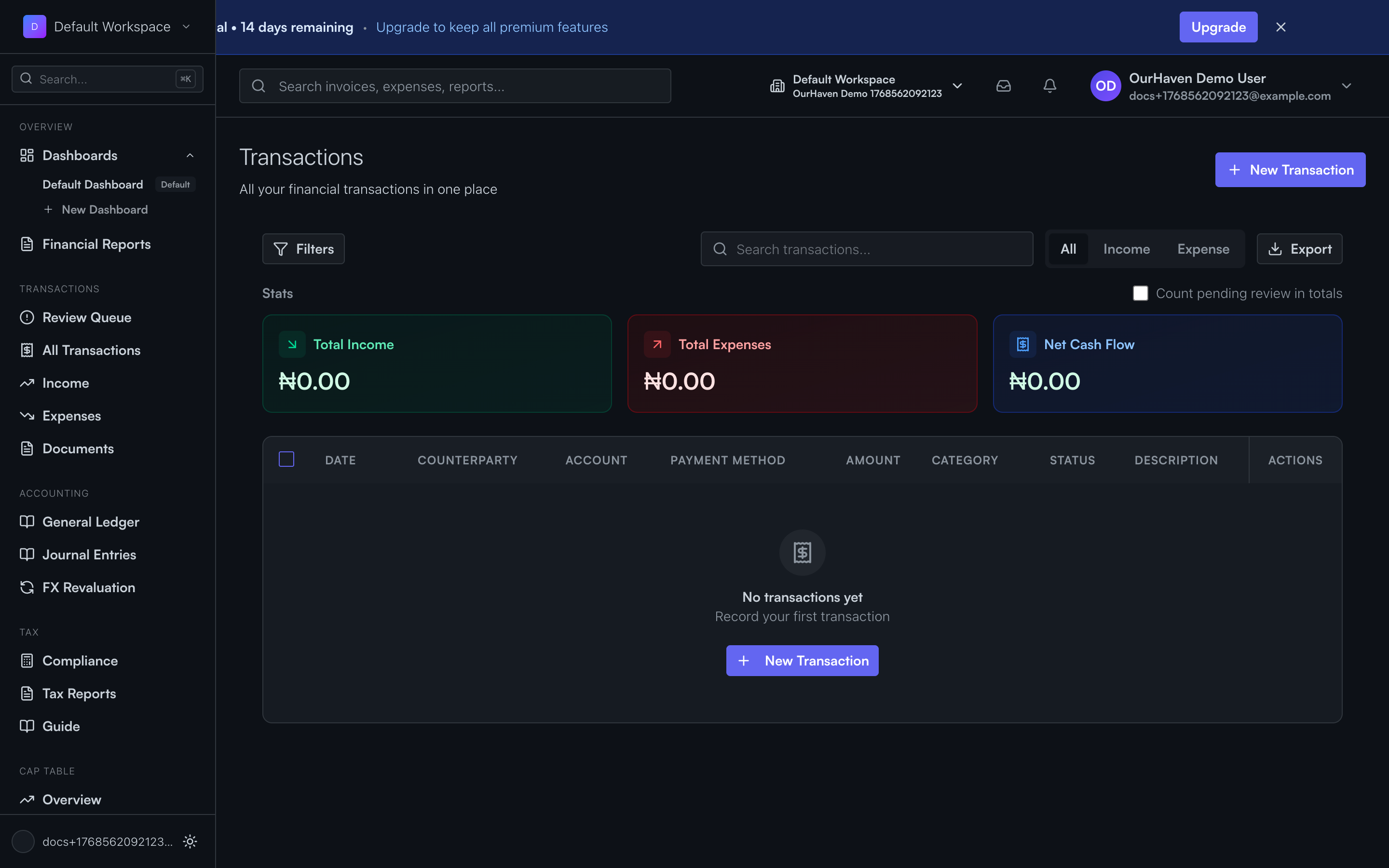

Transaction

Any movement of money. Income, expense, or transfer between accounts.

Category

What the transaction is for. "Office Rent", "Consulting Revenue", "Software Subscriptions".

Money Account

Where money lives. Your bank account, Paystack balance, or petty cash.

Review Queue

Transactions that need your attention before being finalized.

Posted

A transaction that is complete and final. It affects your reports and cannot be deleted.

Ready to start?

The best way to learn is to use it. Start by setting up your business profile and recording a few transactions. Acctally will guide you through the rest.